Jordan Belfort, the notorious stockbroker turned motivational speaker, became infamous for his illegal activities that rocked Wall Street and the financial world. His story, chronicled in his memoir "The Wolf of Wall Street," paints a vivid picture of greed, deception, and excess. But what exactly did Jordan Belfort do that was illegal? This article delves into the details of his unlawful actions and their consequences.

Belfort's rise to fame was as dramatic as his fall from grace. Known for his extravagant lifestyle and unscrupulous business tactics, his actions have left a lasting impact on the financial industry. This article aims to provide a detailed understanding of the illegal activities he engaged in, shedding light on the legal and ethical implications of his actions.

By exploring the depths of Belfort's illegal activities, we can better understand the importance of transparency, integrity, and accountability in the world of finance. This article will serve as a guide to understanding the legal violations committed by Jordan Belfort and their repercussions.

Read also:How Tall Is Paul Mccartney In Feet Discover The Height Of The Legendary Musician

Table of Contents

- Biography of Jordan Belfort

- Early Career and Rise to Prominence

- What Did Jordan Belfort Do That Was Illegal?

- The Pump-and-Dump Scheme

- Money Laundering Operations

- Ethical Violations in Belfort's Business Practices

- Legal Consequences and Sentencing

- Rehabilitation and Redemption

- Lessons Learned from Jordan Belfort's Story

- Conclusion and Call to Action

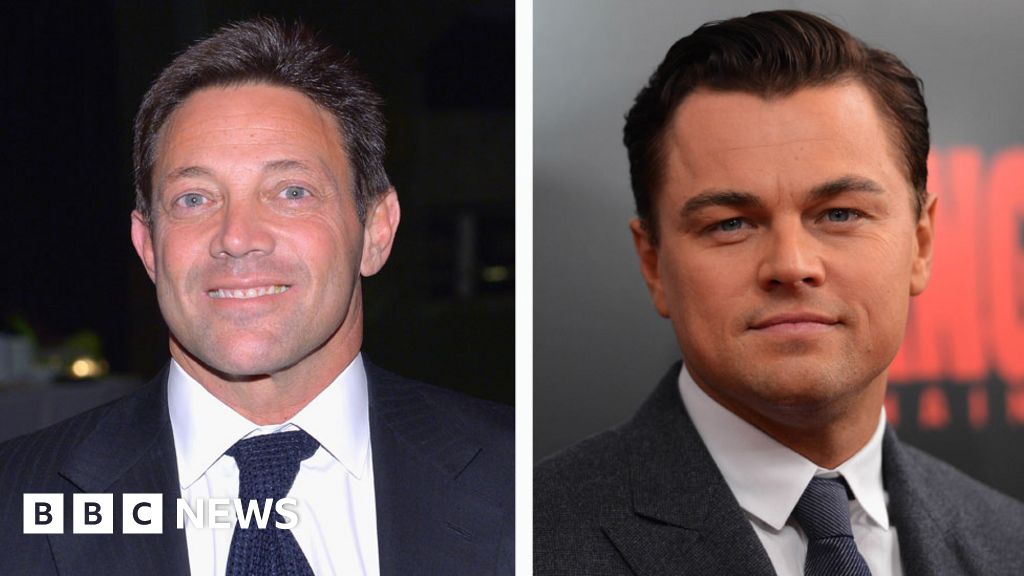

Biography of Jordan Belfort

Jordan Belfort's life is a fascinating tale of ambition, excess, and ultimate downfall. Below is a brief overview of his biography, highlighting key milestones and achievements.

Personal Information

Below is a table summarizing Jordan Belfort's personal information:

| Full Name | Jordan Michael Belfort |

|---|---|

| Date of Birth | July 9, 1962 |

| Place of Birth | Queens, New York, USA |

| Profession | Stockbroker, Motivational Speaker, Author |

| Known For | The Wolf of Wall Street, Pump-and-Dump Schemes |

Early Career and Rise to Prominence

Jordan Belfort began his career on Wall Street in the early 1980s, working as a stockbroker. His natural charisma and salesmanship skills quickly propelled him to success, but it was his unorthodox methods that set him apart. By the late 1980s, Belfort had founded Stratton Oakmont, a brokerage firm that would become the epicenter of his illegal activities.

Stratton Oakmont: The Birth of a Scandal

Stratton Oakmont was not just any brokerage firm; it was a breeding ground for unethical practices. Belfort's firm specialized in selling penny stocks to unsuspecting investors, often using high-pressure sales tactics and misleading information. This laid the foundation for the illegal activities that would eventually lead to his downfall.

What Did Jordan Belfort Do That Was Illegal?

Jordan Belfort's illegal activities were multifaceted and involved a range of unethical practices. Below, we explore the most significant illegal actions he engaged in:

- Engaging in securities fraud through pump-and-dump schemes.

- Participating in money laundering activities.

- Violating ethical standards in financial transactions.

The Pump-and-Dump Scheme

One of the most notorious illegal activities Jordan Belfort engaged in was the pump-and-dump scheme. This involved artificially inflating the price of low-priced stocks through false or misleading statements, then selling them at inflated prices to unsuspecting investors.

Read also:Karan Johar Family A Deep Dive Into The Life And Legacy Of A Bollywood Icon

How the Pump-and-Dump Scheme Worked

Belfort and his team at Stratton Oakmont would:

- Identify low-priced, thinly traded stocks.

- Spread false information about the stocks to create artificial demand.

- Sell the stocks at inflated prices, reaping massive profits while leaving investors with worthless shares.

Money Laundering Operations

In addition to securities fraud, Jordan Belfort was also involved in money laundering. This involved concealing the origins of illegally obtained funds to make them appear legitimate.

Methods of Money Laundering

Belfort used several methods to launder money, including:

- Transferring funds through offshore accounts.

- Using shell companies to disguise the source of funds.

- Investing in luxury assets such as yachts and real estate.

Ethical Violations in Belfort's Business Practices

Beyond the legal violations, Jordan Belfort's business practices were rife with ethical breaches. His focus on personal gain at the expense of others undermined the principles of transparency and trust in the financial industry.

Impact on Investors

The unethical practices employed by Belfort and his team had devastating effects on investors, many of whom lost their life savings. This highlights the importance of ethical conduct in financial dealings.

Legal Consequences and Sentencing

Jordan Belfort's illegal activities eventually caught up with him, leading to legal consequences. In 1999, he pleaded guilty to securities fraud and money laundering, resulting in a 22-month prison sentence.

Reparations and Fines

As part of his legal penalties, Belfort was ordered to pay millions in reparations to victims and fines to regulatory authorities. This served as a reminder of the financial and legal repercussions of engaging in illegal activities.

Rehabilitation and Redemption

Following his incarceration, Jordan Belfort embarked on a path of rehabilitation and redemption. He transformed into a motivational speaker and author, sharing his story as a cautionary tale for others.

Contributions to Society

Belfort's contributions to society include:

- Writing best-selling books such as "The Wolf of Wall Street."

- Delivering lectures on ethical business practices.

- Providing insights into the psychology of sales and success.

Lessons Learned from Jordan Belfort's Story

Jordan Belfort's story offers valuable lessons about the dangers of greed, the importance of ethical conduct, and the consequences of illegal activities. Below are key takeaways:

- Integrity and transparency are essential in all business dealings.

- Unethical practices can lead to severe legal and financial repercussions.

- Redemption is possible, but it requires accountability and genuine remorse.

Conclusion and Call to Action

In conclusion, Jordan Belfort's illegal activities serve as a stark reminder of the dangers of unethical behavior in the financial world. By understanding what he did that was illegal, we can better appreciate the importance of ethical practices and accountability in business.

We invite you to share your thoughts on this article and explore other content on our website. Your feedback is invaluable, and we encourage you to leave a comment or share this article with others. Together, let's promote transparency, integrity, and ethical conduct in all aspects of life.

For further reading, consider exploring reputable sources such as the U.S. Securities and Exchange Commission and Federal Deposit Insurance Corporation for insights into financial regulations and compliance.