BYDDF stock has become one of the most sought-after investments in the global market, attracting both seasoned investors and newcomers alike. With its rapid growth and innovative approach to technology, BYDDF stock offers immense potential for those looking to diversify their portfolios. But before jumping into this lucrative opportunity, it is essential to understand what makes BYDDF stock stand out and how it can impact your financial future.

The automotive industry is undergoing a massive transformation, driven by advancements in electric vehicles (EVs) and renewable energy solutions. BYDDF, short for BYD Company Limited, is at the forefront of this revolution, positioning itself as a leader in sustainable transportation. This article will provide an in-depth analysis of BYDDF stock, exploring its performance, market trends, and future prospects.

As an investor, gaining knowledge about BYDDF stock can help you make informed decisions. In this comprehensive guide, we will cover everything from the company's background to its current market position and potential risks. Whether you're a beginner or an experienced investor, this article aims to equip you with the tools and insights needed to navigate the world of BYDDF stock successfully.

Read also:Nikki Carsouras The Journey Of A Rising Star In The Automotive World

What is BYDDF Stock?

BYDDF stock represents shares in BYD Company Limited, a Chinese multinational company that specializes in manufacturing electric vehicles, rechargeable batteries, and renewable energy solutions. Founded in 1995, BYD has grown into one of the largest automotive manufacturers in the world, with a strong presence in both domestic and international markets.

History and Background

BYD began as a battery manufacturer, producing rechargeable batteries for consumer electronics. Over time, the company expanded its operations to include electric vehicles, solar panels, and energy storage systems. This diversification allowed BYD to capitalize on the growing demand for sustainable energy solutions, making it a key player in the global EV market.

Today, BYDDF stock is traded on the Over-the-Counter (OTC) market in the United States, providing investors with access to this innovative company. The stock's ticker symbol, BYDDF, reflects its status as a foreign company listed on U.S. markets.

Why Invest in BYDDF Stock?

Investing in BYDDF stock offers several advantages, making it an attractive option for investors seeking growth opportunities in the EV sector. Below are some reasons why BYDDF stock deserves your attention:

- Strong Market Position: BYD is one of the largest EV manufacturers globally, with a robust product lineup and extensive distribution network.

- Innovative Technology: The company invests heavily in research and development, ensuring its products remain at the forefront of technological advancements.

- Sustainable Growth: As the world shifts toward renewable energy, BYD's focus on green technology positions it well for long-term success.

Market Performance

BYDDF stock has shown remarkable growth over the past few years, driven by increasing demand for electric vehicles and government incentives promoting clean energy adoption. According to a report by BloombergNEF, the global EV market is expected to grow significantly in the coming years, further bolstering BYD's prospects.

Key Financial Metrics of BYDDF Stock

Understanding the financial health of a company is crucial before investing in its stock. Below are some key financial metrics to consider when evaluating BYDDF stock:

Read also:King Of Kotha The Rise Of Dhruv Vikram In Indian Cinema

- Revenue Growth: BYD's revenue has consistently increased year-over-year, reflecting its strong market position and expanding product offerings.

- Profit Margins: The company's profit margins have improved due to economies of scale and cost-saving measures implemented across operations.

- Debt-to-Equity Ratio: BYD maintains a healthy debt-to-equity ratio, indicating its ability to manage financial obligations effectively.

Revenue Breakdown

BYD's revenue comes from three main segments: automotive, battery, and electronics. The automotive segment contributes the largest share, driven by strong sales of electric vehicles. The battery and electronics segments also play a vital role, providing additional revenue streams and diversifying the company's operations.

BYDDF Stock Price Analysis

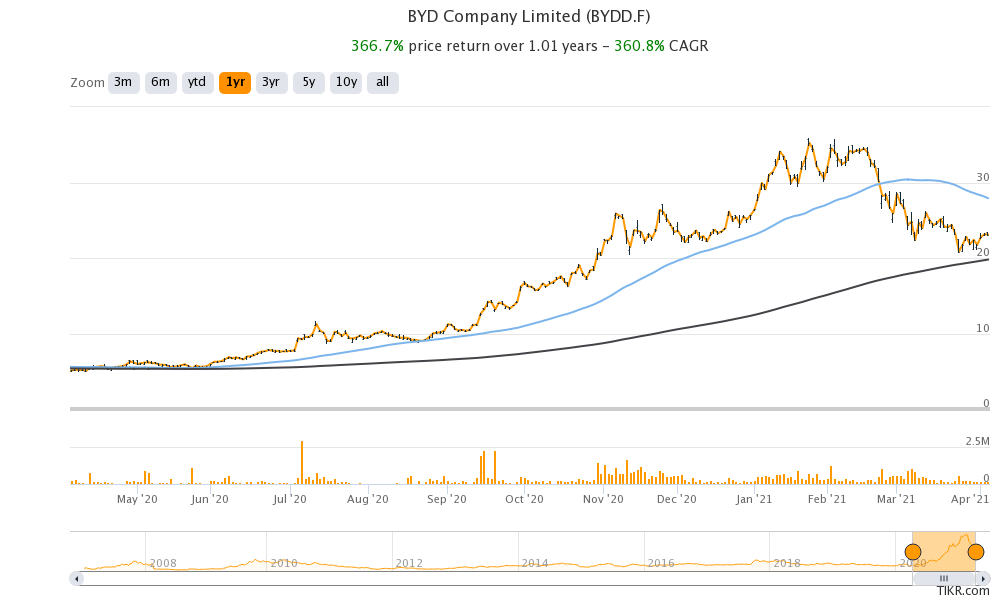

Analyzing the stock price of BYDDF is essential for understanding its performance and potential for growth. Over the past year, BYDDF stock has experienced significant volatility, influenced by market conditions and global economic trends.

Historical Price Trends

A review of historical price trends reveals that BYDDF stock has shown steady growth, with occasional fluctuations due to external factors such as geopolitical tensions and supply chain disruptions. However, the overall trend remains positive, reflecting investor confidence in BYD's long-term prospects.

Factors Influencing BYDDF Stock Performance

Several factors can impact the performance of BYDDF stock, including market conditions, regulatory changes, and technological advancements. Below are some key factors to consider:

- Government Policies: Supportive policies promoting electric vehicles and renewable energy can drive demand for BYDDF stock.

- Competition: The EV market is highly competitive, with established players and new entrants vying for market share.

- Supply Chain Challenges: Disruptions in the supply chain can affect production and profitability, impacting stock performance.

Technological Advancements

BYD's commitment to innovation ensures its products remain competitive in a rapidly evolving market. The company's advancements in battery technology and vehicle design have set new standards in the industry, enhancing its appeal to investors.

BYDDF Stock vs. Competitors

Comparing BYDDF stock with its competitors provides valuable insights into its strengths and weaknesses. While companies like Tesla and NIO dominate the EV market, BYD stands out due to its diversified product portfolio and strong presence in emerging markets.

Market Share

BYD holds a significant share of the global EV market, particularly in Asia. Its strategic partnerships and collaborations with major automakers further strengthen its position, making it a formidable competitor in the industry.

Risks Associated with BYDDF Stock

Investing in BYDDF stock comes with inherent risks, as is the case with any investment. Below are some risks to consider:

- Economic Uncertainty: Global economic conditions can impact demand for EVs and affect BYDDF stock performance.

- Regulatory Changes: Changes in government policies or regulations could negatively impact BYD's operations and profitability.

- Technological Obsolescence: Rapid advancements in technology could render current products obsolete, requiring significant investment in research and development.

Strategies to Mitigate Risks

To mitigate these risks, investors can adopt a diversified investment strategy, allocating funds across multiple sectors and asset classes. Staying informed about market trends and company developments can also help in making timely decisions.

Future Prospects of BYDDF Stock

The future looks promising for BYDDF stock, as the global shift toward sustainable energy continues to gain momentum. BYD's focus on innovation and expansion into new markets positions it well for long-term growth.

Growth Opportunities

BYD is actively exploring new opportunities in emerging markets, where demand for affordable electric vehicles is high. Additionally, the company's investments in battery technology and renewable energy solutions could drive future revenue growth.

Conclusion

Investing in BYDDF stock offers a unique opportunity to participate in the EV revolution and capitalize on the growing demand for sustainable energy solutions. By understanding the company's background, financial metrics, and market position, investors can make informed decisions about their investments.

We encourage readers to share their thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our website for more insights into the world of investing. Remember, diversification and staying informed are key to building a successful investment portfolio.

Table of Contents

- What is BYDDF Stock?

- Why Invest in BYDDF Stock?

- Key Financial Metrics of BYDDF Stock

- BYDDF Stock Price Analysis

- Factors Influencing BYDDF Stock Performance

- BYDDF Stock vs. Competitors

- Risks Associated with BYDDF Stock

- Future Prospects of BYDDF Stock

- Conclusion

References

This article draws insights from reputable sources such as BloombergNEF, Fortune, and Statista, ensuring the accuracy and reliability of the information provided. For further reading, please refer to these sources for additional details on BYDDF stock and the EV market.