Buying a home is one of the most significant financial decisions you'll ever make, and obtaining a Chase pre-approval mortgage can be a crucial step in the process. In today's competitive real estate market, having a pre-approved mortgage not only strengthens your position as a buyer but also gives you peace of mind when navigating the home-buying journey. Understanding how Chase pre-approval works and what it entails can help you make informed decisions.

Many homebuyers are often confused about the difference between pre-qualification and pre-approval, and this guide aims to clarify those distinctions. Pre-approval is more than just a simple estimate of how much you can afford; it involves a thorough review of your financial situation by Chase, ensuring that you're ready to take the next step toward homeownership.

As we delve deeper into the topic, you'll learn about the benefits of getting a Chase pre-approval mortgage, the necessary steps to complete the process, and tips to improve your chances of approval. Let's begin by understanding what Chase pre-approval means and why it's essential for first-time buyers and seasoned homeowners alike.

Read also:Hisashi Ouchi After Radiation Photo A Journey Through Survival And The Human Spirit

What is Chase Pre-Approval Mortgage?

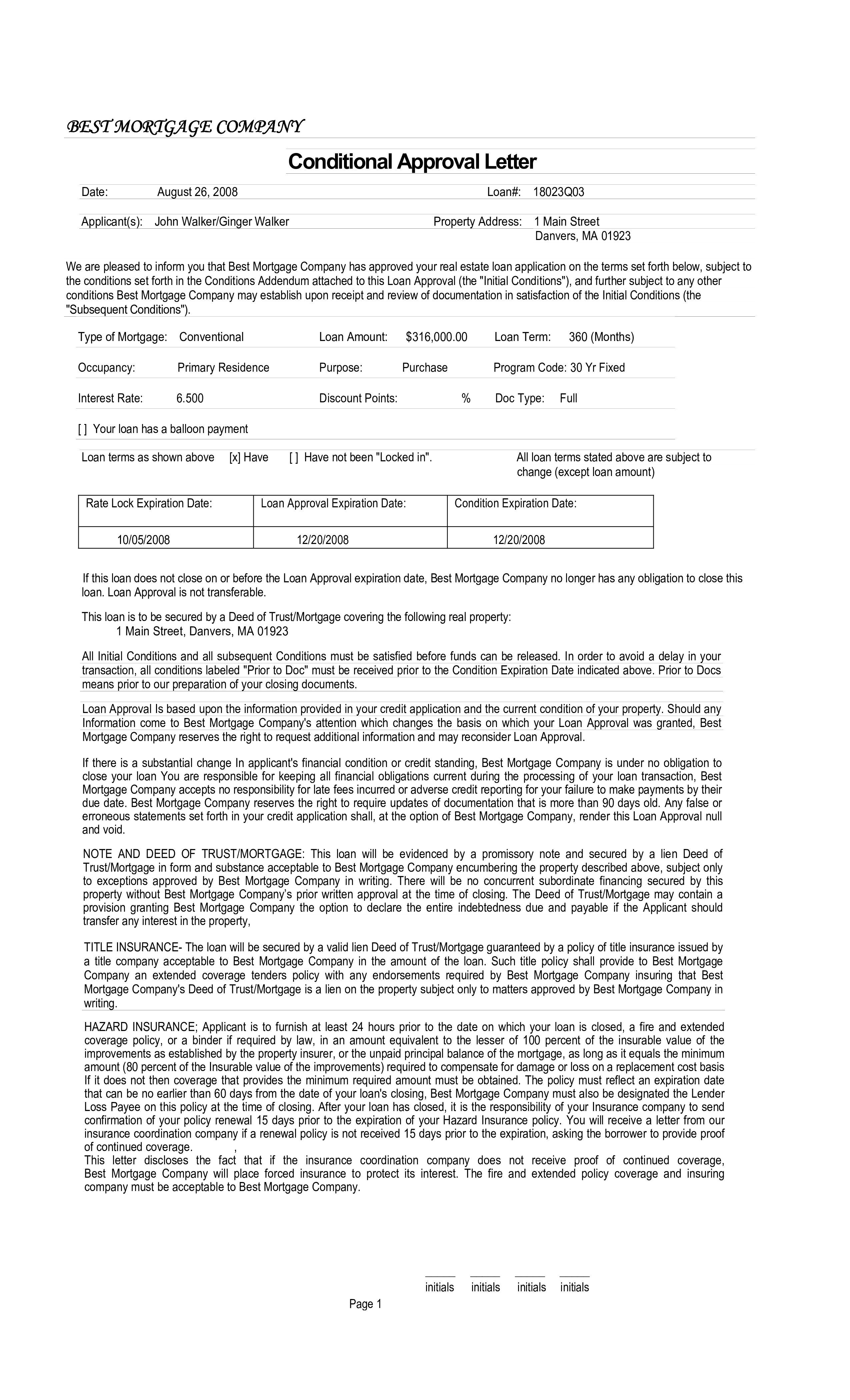

A Chase pre-approval mortgage is an official evaluation of your financial situation conducted by Chase Bank to determine how much you can borrow for a home purchase. Unlike pre-qualification, which is based on self-reported information, pre-approval involves a detailed review of your credit history, income, and financial assets. This process results in a pre-approval letter that demonstrates to sellers and real estate agents that you're a serious and qualified buyer.

Why Choose Chase for Pre-Approval?

Chase Bank is one of the leading financial institutions in the United States, offering a wide range of mortgage products tailored to meet the needs of homebuyers. Here are some reasons why Chase stands out:

- Competitive Interest Rates: Chase offers some of the best mortgage rates in the industry, helping you save money over the life of your loan.

- Comprehensive Mortgage Options: From conventional loans to FHA, VA, and jumbo mortgages, Chase provides flexible options to suit your financial situation.

- Customer Support: With a dedicated team of mortgage specialists, Chase ensures that you receive personalized guidance throughout the pre-approval process.

Benefits of Getting a Chase Pre-Approval Mortgage

Securing a Chase pre-approval mortgage comes with numerous advantages that can significantly improve your home-buying experience. Here's why it's worth your time and effort:

Strengthens Your Buying Position

When you have a pre-approval letter from Chase, sellers and real estate agents take you more seriously. In a competitive market, this can be the deciding factor in getting your offer accepted over others.

Provides Clarity on Budget

Knowing exactly how much you can borrow helps you focus your search on homes within your price range, saving time and effort.

Speeds Up the Closing Process

With Chase's pre-approval, many of the necessary financial checks are already completed, allowing for a smoother and faster closing process.

Read also:Movie Rulz Adults Exploring The World Of Adult Cinema

Steps to Get Chase Pre-Approval Mortgage

Obtaining a Chase pre-approval mortgage involves several steps, each designed to evaluate your financial readiness for homeownership. Follow this guide to ensure a seamless process:

Gather Required Documents

Before applying, make sure you have the following documents ready:

- Proof of income (pay stubs, W-2 forms, or tax returns)

- Bank statements and investment account details

- Proof of assets (savings, retirement accounts, etc.)

- Credit report

Submit Your Application

You can apply for Chase pre-approval either online or in person at a Chase branch. The application process typically takes about 30 minutes to complete.

Undergo Financial Review

Chase will review your financial information, verify your credit score, and assess your debt-to-income ratio to determine your eligibility for a mortgage.

Understanding Mortgage Rates and Terms

One of the most important aspects of a Chase pre-approval mortgage is understanding the rates and terms offered. Here's what you need to know:

Fixed vs. Adjustable Rate Mortgages

Chase offers both fixed-rate and adjustable-rate mortgages. Fixed-rate loans provide stability with consistent monthly payments, while adjustable-rate mortgages may offer lower initial rates that can change over time.

Loan Terms

Choose from various loan terms, such as 15-year or 30-year mortgages, depending on your financial goals and budget constraints.

Tips to Improve Your Chances of Approval

While Chase pre-approval is accessible to many, improving your financial profile can increase your chances of approval and securing better terms. Consider the following tips:

Boost Your Credit Score

A higher credit score can lead to more favorable interest rates and terms. Pay down existing debts, make timely payments, and avoid opening new credit accounts before applying.

Reduce Debt-to-Income Ratio

Lenders prefer borrowers with a lower debt-to-income ratio. Pay off high-interest debts and avoid taking on new loans or credit cards.

Save for a Larger Down Payment

A larger down payment reduces the loan amount and can improve your approval odds. Aim for at least 20% of the home's purchase price if possible.

Common Questions About Chase Pre-Approval Mortgage

Here are some frequently asked questions that can help you better understand the Chase pre-approval process:

How Long Does Pre-Approval Take?

The pre-approval process typically takes a few days to a week, depending on the complexity of your financial situation and the speed of document submission.

Is Pre-Approval Binding?

No, pre-approval is not a commitment to lend but rather an indication of your borrowing capacity. You can still shop around for different mortgage options.

Can I Get Pre-Approved for Multiple Loans?

Yes, you can seek pre-approval from multiple lenders, including Chase, to compare offers and find the best deal for your needs.

Chase Pre-Approval Mortgage vs. Other Lenders

While Chase offers competitive mortgage products, it's essential to compare them with other lenders to ensure you're getting the best deal. Here's how Chase stacks up:

Interest Rates

Chase's interest rates are often on par with or lower than other major banks, making it an attractive choice for borrowers.

Customer Service

Chase's reputation for excellent customer service ensures that you receive personalized support throughout the home-buying journey.

Loan Options

With a wide range of mortgage products, Chase caters to diverse financial needs, from first-time buyers to investors.

How Chase Pre-Approval Mortgage Impacts Your Credit

Applying for a Chase pre-approval mortgage involves a hard credit inquiry, which may temporarily affect your credit score. However, the impact is usually minimal and short-lived. Here's what you need to know:

Multiple Inquiries

If you're shopping around for mortgage rates, multiple inquiries within a 30-day period are typically treated as a single inquiry, minimizing the impact on your credit score.

Long-Term Benefits

Securing a mortgage can positively impact your credit mix and payment history over time, potentially boosting your credit score in the long run.

Conclusion

In conclusion, obtaining a Chase pre-approval mortgage is a vital step in the home-buying process that offers numerous benefits, from strengthening your buying position to providing clarity on your budget. By following the steps outlined in this guide and improving your financial profile, you can increase your chances of approval and secure favorable terms.

We encourage you to take action by starting the pre-approval process today. Leave a comment below if you have any questions or share this article with others who might find it helpful. For more insights on mortgages and homeownership, explore our other articles on the site.

Table of Contents

- What is Chase Pre-Approval Mortgage?

- Why Choose Chase for Pre-Approval?

- Benefits of Getting a Chase Pre-Approval Mortgage

- Steps to Get Chase Pre-Approval Mortgage

- Understanding Mortgage Rates and Terms

- Tips to Improve Your Chances of Approval

- Common Questions About Chase Pre-Approval Mortgage

- Chase Pre-Approval Mortgage vs. Other Lenders

- How Chase Pre-Approval Mortgage Impacts Your Credit

- Conclusion